COMMUNITY SAVINGS BANK

101 E. Union St.

Edgewood, Iowa 52042

ASSESSMENT AREA

Clayton County: All Census Tracts

Delaware County: All Census Tracts

Linn County: All Census Tracts

Dubuque County: Census Tracts 0102.01, 0102.02, 0104.00, and 0105.00

(March 2023 kjb)

OFFICE CLOSINGS AND OPENINGS DURING THE PAST TWO YEARS

Garnavillo Branch Relocated from 101 South Main Street Garnavillo Iowa 52049 to 103 West Clayton Street Garnavillo Iowa 52049

(April 2024 kjb)

LOAN TO DEPOSIT RATIO

March 31, 2024 – 90%

June 30, 2024 – 89%

September 30, 2024 – 91%

December 31, 2024 – 95%

(March 2025 kjb)

HOME MORTGAGE DISCLOSURE ACT NOTICE

The HMDA data about our residential mortgage lending are available online for review. The data shows geographic distribution of loans and applications; ethnicity, race, sex, age, and income of applicants and borrowers; and information about loan approvals and denials. HMDA data for many other financial institutions are also available online. For more information, visit the Consumer Financial Protection Bureau’s Website (www.consumerfinance.gov/hmda).

(March 2023 kjb)

COMMUNITY SAVINGS BANK BRANCHES

Cedar Rapids* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

3414 Mount Vernon Road SE 9:00 AM - 4 :00 PM 9:00 AM - 5:00 PM

Cedar Rapids, Iowa 52403

Phone: 319-363-0577

Fax: 319-363-0578

MSA 16300, Census Tract .00016

Coggon* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

203 East Main Street 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

PO Box 139

Coggon, Iowa 52218

Phone: 319-435-2551

Fax: 319-435-2555

MSA 16300, Census Tract 0101.00

Dyersville* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

1211 12th Avenue SE 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Suite 103

Dyersville, Iowa 52040

Phone: 563-875-6296

Fax: 563-875-6272

MSA 20220, Census Tract 0105.00

Earlville* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

106 Northern Avenue 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Earlville, Iowa 52041

Phone: 563-923-3145

Fax: 563-923-4945

MSA NA (outside of MSA), Census Tract 9501.00

Edgewood* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

101 East Union Street 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Edgewood, Iowa 52042

Phone: 563-928-6425

Fax: 563-928-6240

MSA NA (outside of MSA), Census Tract 9502.00

Garnavillo* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

103 West Clayton Street 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Garnavillo, Iowa 52049

Phone: 800-828-2318

Fax: 563-964-2485

MSA NA (outside of MSA), Census Tract 0701.00

Guttenberg* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

502 South Highway 52 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Phone: 563-252-1048

MSA NA (outside of MSA), Census Tract 0704.00

Manchester* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

221 East Main Street 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Manchester, Iowa 52057

Phone: 563-927-4014

Fax: 563-927-2411

MSA NA (outside of MSA), Census Tract 9503.00

Marion* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

1295 Blairs Ferry Road 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Marion, Iowa 52302

Phone: 319-447-2551

Fax: 319-447-2556

MSA 16300, Census Tract 0003.00

Robins* Monday thru Thursday (Lobby & Drive Thru) Friday (Lobby & Drive Thru)

101 Robins Square Court 9:00 AM – 4:00 PM 9:00 AM – 5:00PM

Robins, Iowa 52328

Phone: 319-294-2783

Fax: 319-294-2784

MSA 16300, Census Tract 0002.06

*24 Hour ATM Available

(March 2025 kjb)

COMMUNITY SAVINGS BANK SERVICE CHARGE MENU

Account activity printout (current month) * $1.87

Account balancing assistance ($10.00 min.) per hour * $18.69

Account Closed within 90 days * $14.01

(Charge not applicable to the following checking account types:

Simply Free Checking, Classic 50 Checking, VIP Direct Checking,

Ultimate Interest Checking, Simply Free Business Checking,

Business Interest Checking and Commercial Checking.)

Account Research ($10.00 min.)/per hour * $18.69

Bank Sweep Manager $28.00

Cashier’s Check – (non CSB Bankclub Member) $5.00

Check Cashing non-customer ($5.00 min.) 3% of amount

Coin Counting non-customers ($5.00 min.) 5% of amount

Copy of extra statement * (per month) $2.80

Counter Checks $1.00 per 5 checks

CSB Debit Card- Annual Fee * (2 card limit) $12.00

CSB Debit Card Replacement * (per card) $18.69

CSB Debit Card Chargeback Research * (per hour) $18.69

CSB Debit Card Hotcard * (includes re-issuance fee) $18.69

Deposit Book (duplicate pad) $9.35

Fax (per page) $2.00

Foreign/Canadian deposited items * $23.37

Garnishments/Levies $50.00

Gift Card $4.95

Inactive Account Fee $10.00

Medallion Signature $50.00 (CSB Customer)

$100.00 (non-CSB Customer)

Mortgage amortization schedule $10.00

Night Deposit Key Deposit/Lost $25.00

Night Deposit Bag (Locking) $25.00

Night Deposit Bag (Zipper) $5.00

Notary (Non-customer) $2.00

Outgoing ACH Recurring (per item) $5.00

Overdraft – per item (Consumer limit of 5 per day) *** $30.00

Paper Statements (per month) $2.80

Personal Money Order (under $5000.00)– (non CSB Bankclub Member) $3.00

Photocopy (Black/White) $.25

Photocopy (Color) $.50

Pre-Authorized Automatic Transfer to avoid Overdraft Charge* $4.67

Return Item (NSF) (per presentment) $30.00

Safe Deposit (Replacement key) $15.00

Select Line of Credit- Annual Fee $40.00

Special Statement cut-off* $4.67

Special Statement handling (waived if E-statement) * $4.67

Stop Payment* $28.04

Travel Card Purchase Card $9.95

Travel Card Reload Card $4.95

Wire Transfer Incoming $10.00

Wire Transfer Domestic outgoing $25.00

Wire Transfer International Outgoing $50.00

Undeliverable Mail Fee $3.00

Personalized Checks, cost will vary.

*Applicable service charges are subject to Iowa State tax, Local Option tax, and Iowa School Local Option Tax

***Overdrafts can be created by check, in-person withdrawal, ATM withdrawal, or other electronic means.

(March 2025 kjb)

COMMUNITY SAVINGS BANK MORTGAGE LOAN PROGRAMS

The following mortgage loan programs are offered by Community Savings Bank:

- Conventional Uninsured (Less than 80% LTV Loans)

- Conventional Insured (Loans with LTV’s of greater than 80% insured by Private Mortgage Insurance)

- In-house Mortgages (For borrowers that may not meet secondary market investor guidelines at the current time)

- IFA FirstHome & IFA FirstHome Plus and Homes for Iowans and Homes for Iowans Plus (Offered through Iowa Finance Authority IFA) Offers low or no down payment fixed rate programs to qualified borrowers.

- IFA Grants are available in conjunction with IFA FirstHome Plus and IFA Homes for Iowans Plus programs for qualified borrowers. We work with IBMC (Iowa Bankers Mortgage Corporation) for the grant programs.

- FHLB HomeStart Grant-Funds are available for $7,500 Down Payment Assistance Grants to qualified low-income first-time homeowner households.

- Mortgage Credit Certificates (MCC’s) Allows the borrower to receive a Federal Tax Credit for a percentage of the interest paid on their home loan. This is funded from year to year by the Iowa Legislature.

- MHOA Military Home Ownership Assistance Grants administered by the Iowa Finance Authority.

- USDA Rural Development Guarantee Loans Zero percent down 30-year mortgage with a RD Guarantee instead of PMI

- Agri-Access Rural Living Loan This program is for rural homes that appraisals may not meet the standard secondary market criteria due to number of acres. We work with IBMC for this program.

- HOAP Program (forgivable grant for improvements—offered through cities)

- Community Seconds Program for cities that are offering incentive to build or rehab in certain parts of the city.

- OSWAP (Onsite Wastewater Assistance Program) Low-interest loans for on-site septic system replacement.

We are able to offer most loan programs offered through the following secondary market investors: Conforming, non-conforming loans and government loans.

Fannie Mae, Universal Lending, AgriAccess, Iowa Finance Authority and Iowa Bankers Mortgage Corporation.

Additionally, we are always looking for new investors, and new programs, that will help a wider variety of borrowers with their mortgage financing needs. This would include low-income borrowers, borrowers with better incomes but no/low down payment, borrowers seeking jumbo financing, and everyone in-between.

(March 2023 kjb)

COMMUNITY SAVINGS BANK SERVICES PROVIDED

Checking Accounts Savings Accounts Wealth Management

Individual Retirement Accounts Private Business Account Manager Money Orders

Cashier’s Checks Stop Payment Orders Wire Transfer Service

Overdraft Protection Corporate Sweep Manager Private Education Loans

Gov’t Guaranteed Student Loan Access Direct Deposit ACH Origination

Safe Deposit Box Night Deposit Box SHAZAM Debit Cards

Escrow Service Notary Service Tax Collection Service

Purchase & Sales of Securities Fax Service Mobile Banking

US Savings Bonds through TreasuryDirect.Gov Mobile Deposit

Internet Online Banking & Bill Pay Mobile Website Telephone Money Line Banking

Merchant Remote Capture Direct Business Loans Website Savings Account Applications

Website Consumer Loan Application Gift Cards Website Mortgage Loan Applications

Credit Cards through Elan Direct Consumer Loans Direct Agricultural Loans

Website Business Loan Applications Residential Mortgage Loans HELOC

Merchant Card Processing

**We are an Equal Housing Lender and Member FDIC

(March 2023 kjb)

COMMUNITY SAVINGS BANK DEPOSIT PRODUCTS

Personal Checking

Smart Spending

- Available to customers ages 18 or under

- Quarterly Educational Newsletter

- Secure Parental Oversight

- Teen-owned Debit Card

- Free Community Savings Bank standard checks

- No monthly maintenance fee

- No minimum balance requirements

- Unlimited check writing

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Person-to-person (P2P) payments available

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Nationwide surcharge-free ATM access via the SHAZAM Privileged Status ATM network

- $50 minimum deposit to open

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Simple Checking

- Simple checking account

- Free Community Savings Bank standard checks

- No monthly maintenance fee

- No minimum balance requirements

- Unlimited check writing

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Person-to-person (P2P) payments available

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Nationwide surcharge-free ATM access via the SHAZAM Privileged Status ATM network

- $50 minimum deposit to open

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

VIP Direct Checking

- Competitive interest on entire balance

- Free Community Savings Bank standard checks

- No monthly maintenance fee

- No minimum balance requirements

- Unlimited check writing

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free CSB Debit Card

- Nationwide surcharge-free ATM access via the SHAZAM Privileged Status ATM network

- $50 minimum deposit to open

*Interest accrues daily based on daily available balance paid monthly.

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Ultimate Interest Checking

- Higher interest rate with a balance of $1,000 and above

- Free Community Savings Bank standard checks

- Avoid the $6 monthly maintenance fee by maintaining a $1,000 minimum daily balance

- Unlimited check writing

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free CSB Debit Card

- Nationwide surcharge-free ATM accessvia the SHAZAM Privileged Status ATM network

- $50 minimum deposit to open

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Personal Savings

Regular Savings Account

- Straightforward savings account

- Avoid the $3.33 monthly maintenance fee by maintaining a $100 minimum daily balance

- 6 free withdrawals per month; $1 fee for withdrawals in excess thereafter

- Free online banking

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $50 minimum deposit to open

Star Plus Money Market Account

- Competitive, tiered interest

- Higher balances earn higher rates

- Interest accrued daily and paid monthly

- Enjoy flexibility with enhanced access to funds, including direct check writing:

- Unlimited in-person withdrawals or by mail

- 6 free transactions per month by pre-authorized automatic, telephone, checks, drafts, or other similar order; $5 per transaction in excess thereafter

- Avoid the $10.00 monthly maintenance fee by maintaining a $2,500 minimum daily balance

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Person-to-person (P2P) paymentsavailable

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Nationwide surcharge-free ATM accessvia the SHAZAM Privileged Status ATM network

- $2,500 minimum deposit to open

Christmas Club Account

- Set aside little by little, year-round for holiday expenses

- Competitive interest on entire balance

- No monthly maintenance fee

- No minimum balance requirements

- Make deposits at any time, in any amount you feel comfortable with

- Avoid holiday-induced debt and stress

- Funds automatically deposited to a Community Savings Bank account in November*

- Early withdrawal will result in a penalty*

- Free online banking

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $1 minimum deposit to open

*All interest earned will be credited annually. You will forfeit all accrued interest if the account is closed prior to it being credited to your account. Minimum deposit to open the account is $1.00.

Vacation Club Account

- Set aside little by little, year-round for vacation expenses

- Competitive interest on entire balance

- No monthly maintenance fee

- No minimum balance requirements

- Make deposits at any time, in any amount you feel comfortable with

- Rest easy right from the start; avoid unnecessary debt

- Funds automatically deposited to a Community Savings Bank account in May*

- Early withdrawal will result in a penalty*

- Free online banking

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $1 minimum deposit to open

*All interest earned will be credited annually. You will forfeit all accrued interest if the account is closed prior to it being credited to your account. Minimum deposit to open the account is $1.00.

Back To School Club Account

- Set aside little by little, year-round for back to school expenses

- Competitive interest on entire balance

- No monthly maintenance fee

- No minimum balance requirements

- Make deposits at any time, in any amount you feel comfortable with

- Rest easy right from the start; avoid unnecessary debt

- Funds automatically deposited to a Community Savings Bank account in July*

- Early withdrawal will result in a penalty*

- Free online banking

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $1 minimum deposit to open

*All interest earned will be credited annually. You will forfeit all accrued interest if the account is closed prior to it being credited to your account. Minimum deposit to open the account is $1.00.

Smart Savings Account

- Competitive interest on entire balance

- No monthly maintenance fee

- No minimum balance requirements

- Establishes the importance and know-how of saving money from an early age

- 6 free transactions per month by pre-authorized automatic, telephone, checks, drafts, or other similar order; $1 per transaction in excess thereafter

- Free online banking

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $1.00 minimum deposit to open

Health Savings Account (HSA)

- Greater personal control over healthcare management and expenses

- Prepare for qualified medical expenses

- Earn interest above standard savings on entire balance

- Receive higher rates on larger deposits

- An HSA provides triple tax savings:

- Tax deductions when you contribute to your account

- Tax-free earnings through investment

- Tax-free withdrawals for qualified medical, dental, vision expenses, and more*

- Contributions are tax-free and can be made by you, your employer, or a third party

- Funds can be withdrawn at any time**

- No monthly maintenance fee

- No minimum balance requirements

- Unused funds remain in account year after year; no "use it or lose it" policy

- Keep your HSA in your name, regardless of career or life changes

- Federally insured by FDIC

- $50 minimum deposit to open

Eligibility

Most adults under 65 who are not enrolled in Medicare and are covered under a high-deductible health plan (HDHP) can qualify for an HSA, but it is up to the account holders to determine their own eligibility. Please contact your tax advisor for further eligibility requirements.

*Consult a tax advisor.

**You can withdraw funds at any time for any purpose. However, if funds are withdrawn for reasons other than qualified medical expenses, the amount withdrawn will be included as taxable income, and is subject to a 10% penalty.

First-Time Homebuyer Savings Accounts

The State of Iowa has established an Iowa First-Time Homebuyer Savings Account program, which may offer tax advantages on savings for qualified home purchases in Iowa. Accounts may be established by qualifying first-time homebuyers or by others on behalf of qualifying first-time homebuyers. It is important to understand the requirements of the program and you may want to consult your tax advisor.

Learn More About First-Time Homebuyers Savings Account

Home Buyer Savings Includes:

- No minimum to open.

- Earn variable interest rates.

- May claim a deduction for Iowa individual income.

You can learn more about this program by visiting https://tax.iowa.gov/ and searching First-Time Homebuyer Savings Account.

Certificates of Deposit (CDs)

- Fixed rates, higher than regular savings

- Receive higher rates by selecting a longer term

- Provides more guarantee than other risky investments

- Set aside for future savings goals

- A wide range of terms available (from 90 days to 5 years)

- No setup or maintenance fees

- Early withdrawals subject to penalty*

- $1,000 minimum deposit to open

*Early withdrawals may result in penalties. Penalties vary depending on the CD.

Individual Retirement Accounts (IRAs)

- Competitive interest above standard savings rates

- Traditional and Roth IRA options

- No setup fees

- No monthly or annual maintenance fees

- $5,500 contribution limit per year

- Additional $1,000 "catch-up" contribution allowed for ages 50+

- Funds can be used to purchase CDs within IRA

- No minimum deposit to open

Traditional & Roth IRAs

Traditional IRA

- No income limits to open

- No minimum contribution requirement

- Contributions are tax deductible on state and federal income tax*

- Earnings are tax deferred until withdrawal (when usually in lower tax bracket)

- Withdrawals can begin at age 59½

- Early withdrawals subject to penalty**

- Mandatory withdrawals at age 70½

Roth IRA

- Income limits to be eligible to open Roth IRA***

- Contributions are NOT tax deductible

- Earnings are 100% tax free at withdrawal*

- Principal contributions can be withdrawn without penalty*

- Withdrawals on interest can begin at age 59½

- Early withdrawals on interest subject to penalty**

- No mandatory distribution age

- No age limit on making contributions as long as you have earned income

*Subject to some minimal conditions. Consult a tax advisor.

**Certain exceptions apply, such as healthcare, purchasing first home, etc.

***Consult a tax advisor.

COVERDELL ESA

College isn’t getting any cheaper. That makes saving for your child’s education so important. Our Coverdell Education Savings Account (ESA) provides a safe, tax-free place to set funds aside — and earn competitive interest.

- Set aside funds for your child's education

- No setup or annual fee

- Dividends grow tax-free

- Withdrawals are tax-free and penalty-free when used for qualified education expenses*

- Designated beneficiary must be under 18 when contributions are made

- To contribute to an ESA, certain income limits apply**

- Contributions are not tax deductible

- $2,000 maximum annual contribution per child

- The money must be withdrawn by the time he or she turns 30***

- The ESA may be transferred without penalty to another member of the family

- $250 minimum deposit to open

*Qualified expenses include tuition and fees, books, supplies, board, etc.

**Consult your tax advisor to determine your contribution limit.

***Those earnings are subject to income tax and a 10% penalty.

Business Checking Accounts

Simple Business Checking

- Simplified checking solution

- No monthly maintenance fee

- No minimum balance requirements

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Business servicesavailable

- $50 minimum deposit to open

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Business Interest Checking

- Available to non-profit organizations and sole proprietorships

- Competitive tiered interest on entire balance

- Avoid the $6 monthly maintenance fee by maintaining a $1,000 minimum daily balance

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Business servicesavailable

- $50 minimum deposit to open

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Commercial Checking

- Ideal for businesses with large transaction volumes

- Unlimited monthly transactions available at low per-item fees

- $10 monthly maintenance fee

- Receive an earnings credit to offset or minimize monthly fees incurred***

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- Business services available

- $50 minimum deposit to open

***Earnings credit based on balance requirements.

*Other fees such as overdraft, return (NSF), paper statements, etc. may apply. See fee schedule for details. Offer good on personal accounts only. Ask us about our great business checking plans including Simple Business Checking. Bank rules and regulations apply. Minimum opening deposit is only $50. Ask us for details.

Business Savings Accounts

Regular Business Savings Account

- Convenient savings solution

- Competitive interest on balances of $100 or more

- Avoid the $3.33 monthly service fee by maintaining a $100 minimum daily balance

- 6 free withdrawals per month; $1 fee for withdrawals in excess thereafter

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- $100 minimum deposit to open

Business Star Plus Money Market Account

- Competitive, tiered interest

- Higher balances earn higher rates

- Interest accrued daily and paid monthly

- Enjoy flexibility with enhanced access to funds, including direct check writing:

- Unlimited in-person withdrawals or by mail

- 6 free transactions per month by pre-authorized automatic, telephone, checks, drafts, debit cards, or other

- similar order; $5 per transaction in excess thereafter

- Avoid the $10.00 monthly service fee by maintaining a $2,500 minimum daily balance

- Free online banking & bill pay

- Free mobile banking with mobile deposit

- Free e-statements

- Free telephone banking

- Free Mastercard® debit card

- $2,500 minimum deposit to open

Business Retirement Accounts

Simplified Employee Pension (SEP IRA)

- Ideal for businesses of any size or self-employed individuals

- Gain the respect of your employees

- Help employees reach their retirement savings goals

- Employee always has complete ownership of all SEP IRA money

- Earn competitive interest on entire balance

- Contributions are tax deductible; your business pays no taxes on earnings

- Contributions made only by the employer

- Only self-employed may make contributions on their own behalf

- Little to no documents to file with government

- Inexpensive to set up and operate

- Flexible annual contributions – good plan if cash flow is unpredictable

- Can contribute up to 25% of each participant's annual compensation (earned income)

- Or, up to the maximum allowable limit for current plan year, whichever is less

- Must contribute equally for all employees

- Employee must first establish a traditional IRA, in which the employer will deposit SEP contributions

- No minimum deposit to open

Savings Incentive Match Plan for Employees (SIMPLE IRA)

- Available to any small business – generally with 100 or fewer employees

- Gain the respect of your employees

- Employees have the option to make self-contributions

- Help employees reach their retirement savings goals

- Employee always has complete ownership of all SIMPLE IRA money

- Earns a competitive interest rate

- Employer must not have any other retirement plan

- Minimal paperwork necessary; no filing requirements

- Inexpensive to set up and operate

- Lower contribution limits than some other retirement options

- Employees share responsibility of growing their retirement

- Each year, employer is required to contribute:

- Matching contribution up to 3% of compensation, or

- 2% non-elective contribution for each eligible employee

- No minimum deposit to open

COMMUNITY SAVINGS BANK LOAN PRODUCTS

Personal Loans

Student Loans

We work with ISL Education Lending to offer private loans to help you pay for college as well as refinance existing student loans. ISL Education Lending is a nonprofit organization with decades of student loan experience offering lower-priced loans.*

ISL Education Lending offers:

- Loans for college students.

- A loan option for parents and family members who wish to borrow on behalf of a college student.

- Multiple student loan refinance options.

In addition, they offer multiple scholarship opportunities and free college planning tools to help students and families avoid overborrowing and plan smart for life during and after college.

Home Mortgage Loans

- Competitive rates for home purchase, refinance, or construction

- Several financing programs available

- Loan advisors with working knowledge of the local real estate market

Home Equity Loans

- Competitive rates for short-term or ongoing needs

- The existing equity in your home is used as collateral

- Term loan and line of credit options available

Parent Refinance Loan

Student Loan Consolidation

- Competitive rates to consolidate and refinance one or multiple loans

- One easy payment to manage

- Private and Federal loans are eligible for consolidation

Auto Loans

- Competitive rates on new or used vehicles*

- A wide range of terms customized to your unique situation

- Pre-approval available for extra bargaining power

Personal Term Loans

- Competitive rates for a wide variety of personal needs

- Repayment terms customized to fit your unique needs

- Local decision-making and processing

Business Loans

Small Business Administration (SBA) Loans

- Government-assisted financing for qualifying businesses

- A wide range of lending options available

- Generally lower down payments and extended terms

Business Term Loans

- Competitive rates for a wide range of business expenses

- Repayment terms customized to your business needs

- Local decision-making and processing

Business Lines of Credit

- Competitive rates for long-term or seasonal business needs

- Funds available right as you need them

- Only pay interest on the part that's used

Accounts Receivables Financing

- Unlocks working capital and enhances cash flow

- Provides quick access to cash when you need it

- More flexibility than traditional financing

Commercial Real Estate Loans

- Competitive rates to build, buy or refinance commercial properties

- Available for owner-occupied or investment properties

- Loan advisors with working knowledge of the local real estate market

Agricultural Loans

Equipment Loans

- Competitive rates for new or used equipment

- Meet needs without cutting into working capital or savings

- Avoid lapsed periods in production and outdated equipment

Agriculture Real Estate Loans

- Competitive rates to buy or refinance agriculture properties

- Repayment terms customized to fit your operation's needs

- Loan advisors with working knowledge of the local real estate market

Operating Lines of Credit

- Competitive rates for long-term or seasonal agriculture needs

- Funds available right as you need them

- Only pay interest on the part that's used

(March 2025 kjb)

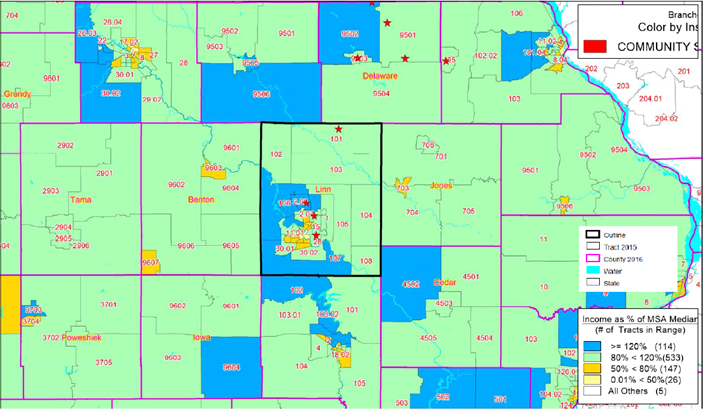

COMMUNITY SAVINGS BANK ASSESSMENT AREA MAP 2021

Community Savings Bank Cert 14633

Edgewood, Iowa

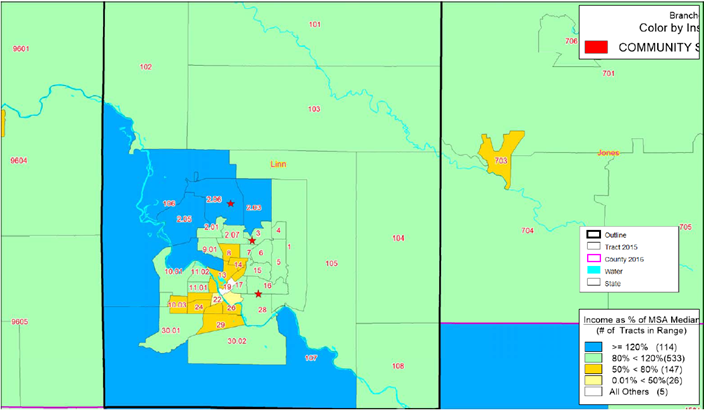

ACS - Cedar Rapids Metro AA - Incomes

Community Savings Bank Cert 14633

Edgewood, Iowa

ACS - Cedar Rapids Metro AA - Income CLOSER

Community Savings Bank Cert 14633

Edgewood, Iowa

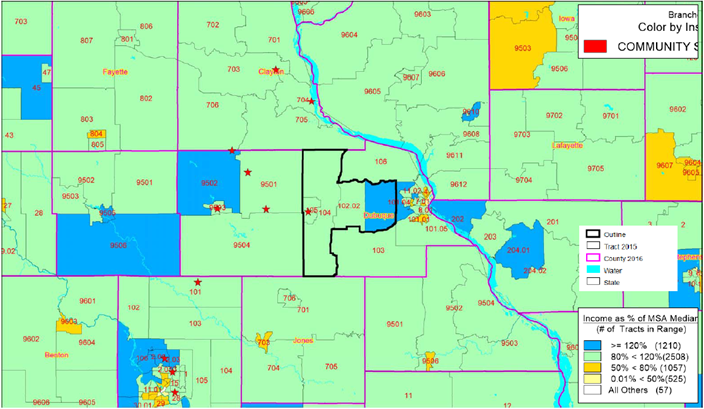

ACS - Dubuque Metro AA - Income

Community Savings Bank Cert 14633

Edgewood, Iowa

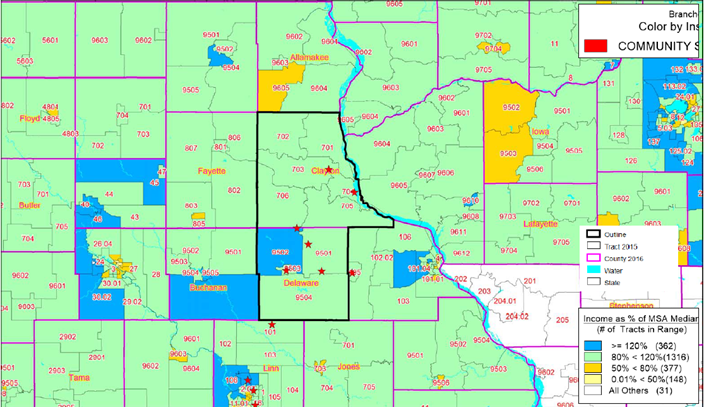

ACS - Non-Metro AA - Income

PUBLIC DISCLOSURE

May 6, 2024

COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION

Community Savings Bank Certificate Number: 14633

101 East Union Street Edgewood, Iowa 52042

Federal Deposit Insurance Corporation Division of Depositor and Consumer Protection Kansas City Regional Office

1100 Walnut Street, Suite 2100 Kansas City, Missouri 64106

This document is an evaluation of this institution’s record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, nor should it be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution.

TABLE OF CONTENTS

DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW....................... 11

CEDAR RAPIDS METRO ASSESSMENT AREA – Full-Scope Review.................................. 17

DUBUQUE METRO ASSESSMENT AREA – Limited-Scope Review..................................... 23

INTERMEDIATE SMALL BANK PERFORMANCE CRITERIA........................................ 26

INSTITUTION RATING

INSTITUTION’S CRA RATING: This institution is rated Satisfactory.

An institution in this group has a satisfactory record of helping to meet the credit needs of its assessment areas, including low- and moderate-income neighborhoods, in a manner consistent with its resources and capabilities.

Community Savings Bank’s (CSB) satisfactory Community Reinvestment Act (CRA) performance under both the Lending and Community Development Tests supports the rating. The following points summarize the bank’s Lending Test and Community Development Test performance.

The Lending Test is rated Satisfactory.

- The loan-to-deposit ratio is reasonable given the institution’s size, financial condition, and credit needs of the assessment areas.

- A majority of small farm, small business, and home mortgage loans are inside the assessment

- The geographic distribution of loans reflects reasonable dispersion throughout the assessment areas reviewed.

- The distribution of borrowers reflects reasonable penetration among farms and businesses of different sizes, as well as individuals of different income levels.

- The institution did not receive any CRA-related complaints since the previous evaluation; therefore, this factor did not affect the Lending Test rating.

The Community Development Test is rated Satisfactory.

- The institution demonstrated adequate responsiveness to the community development needs of its assessment areas through community development loans, qualified investments, and community development services. Examiners considered the institution’s capacity, as well as the need and availability of opportunities in the assessment areas.

DESCRIPTION OF INSTITUTION

CSB is a commercial bank headquartered in Edgewood, Iowa. CSB is wholly owned by Community Financial Corporation, Edgewood, Iowa. The institution received a Satisfactory rating at its previous Federal Deposit Insurance Corporation Performance Evaluation dated May 24, 2021, based on Interagency Intermediate Small Institution Examination Procedures. CSB currently operates from ten full-service offices in eastern Iowa. In November 2023, the Garnavillo branch relocated approximately a half mile within the same census tract as the previous location. No branches have been opened or closed and no merger or acquisition activities have occurred during the review period. Further, there are no lending affiliates or subsidiaries for consideration in this evaluation.

CSB offers various loan products, including agricultural, commercial, home mortgage, and consumer loans. CSB’s primary focus is on agricultural and commercial lending. The bank also offers financing alternatives through the following loan programs: Small Business Administration,

U.S. Department of Agriculture Rural Development, Farm Service Agency, Federal Housing Administration, Veterans Administration, Federal Home Loan Bank Homeownership grants, and Iowa Finance Authority. These programs are generally designed to assist small businesses, small farmers, veterans, and low- or moderate-income individuals who may not qualify for loans through conventional financing methods. Secondary market financing options are available for qualifying borrowers. The bank also participated in the Small Business Administration’s Paycheck Protection Program (PPP) during the review period. This program provided financial aid to farms and businesses impacted by the COVID-19 pandemic.

The institution provides a variety of deposit products, including checking, savings, money market, health savings, certificates of deposit, and individual retirement accounts. CSB also offers trust and wealth management services. Alternative banking products or services include debit and credit cards, direct deposit, internet and mobile banking, electronic bill pay, telephone banking, mobile check deposit, electronic statements, and night deposit facilities. Business Management services include credit card processing, Automated Clearing House services, and Remote Deposit. CSB also operates deposit-taking automated teller machines located at all ten bank offices; some with multiple terminals. Interactive teller machines were operational at the Coggon, Cedar Rapids, Guttenberg, and Manchester branch locations, but were converted to automated teller machines in April 2023.

Assets totaled approximately $588.0 million as of March 31, 2024, representing an increase of 17.4 percent since the March 31, 2021, Consolidated Reports of Condition and Income (Call Report).

Total deposits equaled approximately $468.0 million, representing a 15.4 percent increase, and total loans were approximately $427.3 million, representing a 24.0 percent increase during the same timeframe. Portfolio concentrations remained generally consistent over the period; however, residential real estate concentrations increased whereas agriculture and commercial loan concentrations both decreased. Management attributes overall loan and deposit increases to successful strategic growth. The following table illustrates the composition of the loan portfolio as of March 31, 2024.

|

Loan Portfolio Distribution as of 3/31/2024 |

||

|

Loan Category |

$(000s) |

% |

|

Construction, Land Development, and Other Land Loans |

25,652 |

6.0 |

|

Secured by Farmland |

81,695 |

19.1 |

|

Secured by 1-4 Family Residential Properties |

75,677 |

17.7 |

|

Secured by Multifamily (5 or more) Residential Properties |

9,472 |

2.2 |

|

Secured by Nonfarm Nonresidential Properties |

113,157 |

26.5 |

|

Total Real Estate Loans |

305,653 |

71.5 |

|

Commercial and Industrial Loans |

61,160 |

14.3 |

|

Agricultural Production and Other Loans to Farmers |

43,003 |

10.1 |

|

Consumer Loans |

11,389 |

2.7 |

|

Obligations of State and Political Subdivisions in the U.S. |

3,487 |

0.8 |

|

Other Loans |

2,579 |

0.6 |

|

Lease Financing Receivable (net of unearned income) |

0 |

0.0 |

|

Less: Unearned Income |

(0) |

(0.0) |

|

Total Loans |

427,271 |

100.00 |

|

Source: Call Report |

||

Examiners did not identify any financial, legal, or other impediments that affect the bank’s ability to meet the credit or community development needs of its assessment areas.

DESCRIPTION OF ASSESSMENT AREAS

The CRA requires each financial institution to define one or more assessment areas within which examiners will evaluate its CRA performance. CSB has defined three contiguous assessment areas within the State of Iowa. The Nonmetropolitan (Non-Metro) Assessment Area is in the nonmetropolitan portion of Iowa. The Cedar Rapids Metro and Dubuque Metro assessment areas are in metropolitan statistical areas (MSAs). Refer to subsequent sections for detailed information on each assessment area.

SCOPE OF EVALUATION

General Information

This evaluation covers the period from the prior evaluation dated May 24, 2021, to the current evaluation date of May 6, 2024. Examiners used the Interagency Intermediate Small Institution Examination Procedures to evaluate the institution’s CRA performance. Related procedures include the Lending and Community Development Tests, which the Appendices describe in detail.

Performance reviews considered the institution’s lending activities in relation to demographics and credit needs of the assessment areas. To evaluate performance, examiners conducted full-scope reviews in the Non-Metro and Cedar Rapids Metro assessment areas, and a limited-scope review in the Dubuque Metro Assessment Area after considering factors such as branching structure, deposit volume, loan volume, market share, and reviews performed at previous CRA evaluations. As shown in the following table, the vast majority of CSB’s loans, deposits, and branches are in the

Non-Metro Assessment Area. Therefore, the bank’s Lending Test and Community Development Test performance in the Non-Metro Assessment Area received the most weight in the overall evaluation. The following table reflects the distribution of loans, deposits, and office locations by assessment area.

|

Assessment Area Breakdown of Loans, Deposits, and Branches |

||||||

|

Assessment Area |

Loans |

Deposits |

Branches |

|||

|

$(000s) |

% |

$(000s) |

% |

# |

% |

|

|

Non-Metro |

225,233 |

52.9 |

329,387 |

70.4 |

5 |

50.0 |

|

Cedar Rapids Metro |

152,737 |

35.8 |

113,278 |

24.2 |

4 |

40.0 |

|

Dubuque Metro |

48,151 |

11.3 |

25,235 |

5.4 |

1 |

10.0 |

|

Total |

426,121 |

100.0 |

467,900 |

100.0 |

10 |

100.0 |

|

Source: Bank Data; Federal Deposit Insurance Corporation Summary of Deposits (6/30/2023) |

||||||

Activities Reviewed

The institution’s major product lines are agricultural, commercial, and residential real estate loans. Examiners based this conclusion on the institution’s business strategy, loan portfolio distribution, and the number and dollar volume of loans originated or renewed during the evaluation period.

Therefore, examiners reviewed small farm, small business, and home mortgage lending to evaluate CSB’s lending performance. Overall, examiners gave greater weight to small farm and small business lending, followed by home mortgage lending, when drawing conclusions given the bank’s lending focus. The table below provides information on the number and dollar volume of loans reviewed.

|

Loan Products Reviewed |

||||||

|

Loan Category |

Universe |

Universe Inside Assessment Areas |

Reviewed* |

|||

|

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

|

|

Small Farm |

171 |

17,277 |

151 |

15,377 |

55 |

4,298 |

|

Small Business |

200 |

29,230 |

152 |

19,067 |

93 |

7,672 |

|

Home Mortgage |

|

|||||

|

2021 |

518 |

86,880 |

388 |

63,484 |

388 |

63,484 |

|

2022 |

373 |

56,662 |

283 |

38,186 |

283 |

38,186 |

|

2023 |

221 |

33,646 |

171 |

25,382 |

171 |

25,382 |

|

Source: Bank Data; HMDA Reported Data; (*) Loans reviewed for the Borrower Profile analysis |

||||||

For the Assessment Area Concentration review, examiners evaluated lending performance based on all small farm and small business loans originated or renewed in calendar year 2023, as well as Home Mortgage Disclosure Act (HMDA) data collected and reported for 2021, 2022, and 2023.

For the Geographic Distribution review, examiners evaluated lending performance based on all loans located inside the assessment areas containing low- or moderate-income geographies. In addition, 2021 HMDA data was not separately analyzed for Geographic Distribution in the Non- Metro Assessment Area, as there were no low- or moderate-income geographies based on 2015 America Community Survey (ACS) data. For the Borrower Profile analysis, all home mortgage loans within each assessment area were reviewed; however, for small farm and small business

loans, examiners used a sample of loans originated or renewed inside the assessment areas. Small farm lending was not reviewed for Geographic Distribution or Borrower Profile in the Cedar Rapids Metro Assessment Area due to negligible activity caused by low demand, and that it is not a primary business focus in that market. Details are discussed in the applicable assessment area sections.

For small farm and small business conclusions, 2023 D&B data provided a standard of comparison. HMDA aggregate data for 2021 and 2022, 2015 ACS data, and 2020 U.S. Census data provided a standard of comparison for the home mortgage loans reviewed. Examiners primarily focused on CSB’s lending performance in comparison to HMDA aggregate data, when available. Lending performance for 2021 and 2023 was reviewed to ensure that performance was consistent with 2022. In general, examiners did not identify any significant trends between the three years of HMDA data that materially affected conclusions. Therefore, only 2022 HMDA data is presented for the Geographic Distribution and Borrower Profile criteria, as 2022 is the most recent year with available aggregate data. Examiners noted a declining trend in home mortgage lending activity during the review period. Management attributes the falling volume to rising interest rates and related demand. However, the difference in home mortgage lending volume did not result in trends that materially affected conclusions. Any differences in CSB’s home mortgage lending performance between HMDA reporting years are discussed in subsequent sections.

For the Community Development Test, examiners reviewed data presented by management on community development loans, qualified investments, and community development services provided since the prior CRA evaluation.

CONCLUSIONS ON PERFORMANCE CRITERIA

LENDING TEST

CSB demonstrated overall reasonable performance under the Lending Test. The bank’s reasonable performance under each criterion supports this conclusion. The following is a discussion of each performance criterion and how they support the bank’s overall rating.

Loan-to-Deposit Ratio

CSB’s average net loan-to-deposit ratio is reasonable given the institution’s size, financial condition, assessment area credit needs, and in comparison to similarly-situated institutions. The institution’s net loan-to-deposit ratio, calculated from Call Report data, averaged 82.3 percent over the 12 calendar quarters from June 30, 2021, to March 31, 2024. The net loan-to-deposit ratio ranged from a high of 92.3 percent as of December 31, 2023, to a low of 72.2 percent as of June 30, 2022. The ratio generally declined over the first part of the review period as gains in total deposits outpaced net loans. However, the ratio showed significant rebounds beginning in June 2022.

Examiners compared CSB’s average net-loan-to-deposit ratio with those of four similarly-situated institutions to evaluate the institution’s performance. Examiners selected comparable institutions based on similarities in lending focus, asset size, or markets served. As shown in the following table, CSB’s ratio is similar to comparable institutions.

|

Loan-to-Deposit Ratio Comparison |

||

|

Bank |

Total Assets as of 3/31/24 ($000s) |

Average Net Loan-to-Deposit Ratio (%) |

|

Community Savings Bank, Edgewood, Iowa |

587,961 |

82.3 |

|

BankIowa, Cedar Rapids, Iowa |

845,894 |

83.6 |

|

FreedomBank, Elkader, Iowa |

450,917 |

78.0 |

|

Farmers & Merchants Savings Bank, Manchester, Iowa |

612,413 |

77.0 |

|

Citizens State Bank, Monticello, Iowa |

511,355 |

51.7 |

|

Source: Call Reports 6/30/2021 – 3/31/2024 |

||

The institution also originates and subsequently sells mortgage loans through secondary market relationships; these loans are not included in the institution’s ratio. CSB reported originating and selling 365 loans totaling approximately $58.7 million on the secondary market from the prior evaluation date through March 31, 2024. While the sale of secondary market loans does not influence the average net loan-to-deposit ratio, this activity provides liquidity to originate additional home mortgage loans. Secondary market lending is responsive to the assessment area’s credit needs by providing long-term home mortgage financing.

Assessment Area Concentration

As shown in the following table, the institution originated a majority of small farm, small business, and home mortgage loans inside its assessment areas.

|

Lending Inside and Outside of the Assessment Areas |

||||||||||

|

Loan Category |

Number of Loans |

Total # |

Dollar Amount of Loans $(000s) |

Total $(000s) |

||||||

|

Inside |

Outside |

Inside |

Outside |

|||||||

|

# |

% |

# |

% |

$ |

% |

$ |

% |

|||

|

Small Farm |

151 |

88.3 |

20 |

11.7 |

171 |

15,377 |

89.3 |

1,850 |

10.7 |

17,227 |

|

Small Business |

152 |

76.0 |

48 |

24.0 |

200 |

19,067 |

65.2 |

10,163 |

34.8 |

29,230 |

|

Home Mortgage |

|

|||||||||

|

2021 |

388 |

74.9 |

130 |

25.1 |

518 |

63,484 |

73.1 |

23,396 |

26.9 |

86,880 |

|

2022 |

283 |

75.9 |

90 |

24.1 |

373 |

38,186 |

67.4 |

18,477 |

32.6 |

56,663 |

|

2023 |

171 |

77.4 |

50 |

22.6 |

221 |

25,382 |

75.4 |

8,264 |

24.6 |

33,646 |

|

Home Mortgage Total |

842 |

75.7 |

270 |

24.3 |

1,112 |

127,052 |

71.7 |

50,137 |

28.3 |

177,189 |

|

Source: Bank Data Due to rounding, totals may not equal 100.0% |

||||||||||

Geographic Distribution

The geographic distribution of loans reflects reasonable dispersion throughout the reviewed assessment areas. The review of this criterion focused on the institution’s record of lending in low- and moderate-income census tracts within the Non-Metro and Cedar Rapids Metro assessment areas. The bank’s reasonable lending performance in the Non-Metro Assessment Area, which was provided the most weight, supports this conclusion. Although poor dispersion was noted in the

Cedar Rapids Metro Assessment Area due to its small business performance, it did not influence the overall conclusion. Examiners focused primarily on the percentage, by number of loans, in low- and moderate-income census tracts located in each of the assessment areas. The Dubuque Metro Assessment Area has no low- or moderate-income census tracts; therefore, this criterion was not evaluated for this assessment area. Refer to comments under each separately analyzed assessment area for a more specific analysis.

Borrower Profile

The distribution of borrowers reflects reasonable penetration among farms and businesses of different sizes, and individuals of different income levels. The bank’s reasonable lending performance in each assessment area supports this conclusion. Examiners focused on the percentage, by number of loans, to businesses and farms generating gross annual revenues of $1 million or less, and on the percentage, by number of loans, to low- and moderate-income borrowers. Refer to comments under each separately analyzed assessment area for a more specific analysis.

Response to Complaints

The institution has not received any CRA-related complaints since the previous evaluation; therefore, this criterion did not affect the Lending Test rating.

COMMUNITY DEVELOPMENT TEST

CSB demonstrated adequate responsiveness to the community development needs of its assessment areas through community development loans, qualified investments, and community development services. Examiners considered the institution’s capacity and the need and availability of such opportunities to evaluate the bank’s performance under this test. Because the bank was responsive to the community development needs of its assessment areas, community development activities benefitting the broader statewide or regional area were included in the analysis.

Information from performance evaluations of three intermediate small banks conducted during the evaluation period was used for comparative purposes to assess CSB’s overall performance under the Community Development Test. The institutions were chosen due to similarities in asset size or types of areas served. CSB’s overall community development performance compared reasonably to these institutions when considering available community development opportunities in the assessment areas.

Community Development Loans

CSB originated 75 community development loans totaling approximately $7.8 million during the evaluation period. As the bank was responsive to assessment area community development needs, the overall total also includes $881,000 in community development loans benefitting the broader statewide area that includes the bank’s assessment areas. CSB extended loans to entities to promote economic development by supporting permanent job creation, retention, and/or improvement for low- and moderate-income persons, and to aid revitalization or stabilization efforts.

CSB’s total community development loans represent 1.3 percent of total assets and 1.8 percent of net loans, as of March 31, 2024. The comparable institutions had community development loans to total assets ratios ranging from 0.9 percent to 2.4 percent, and community development loans to net

loans ratios ranging from 1.8 percent to 4.8 percent. CSB’s ratios compare reasonably to these institutions. As all three comparable institutions’ community development lending activity also included a significant number of PPP loans, examiners calculated comparable bank ratios exclusive of this activity. In comparison to the prior evaluation, CSB’s community development loans increased substantially by both number and dollar volume from 53 loans totaling $1.3 million, when excluding the prior evaluation’s PPP activity. The following tables reflect the number and dollar volume of community development lending in each category by assessment area and activity year.

|

Community Development Lending by Assessment Area |

||||||||||

|

Assessment Area |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|||||

|

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

|

|

Non-Metro |

0 |

0 |

0 |

0 |

48 |

3,484 |

3 |

354 |

51 |

3,838 |

|

Cedar Rapids Metro |

0 |

0 |

0 |

0 |

13 |

2,862 |

2 |

180 |

15 |

3,042 |

|

Dubuque Metro |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Statewide |

0 |

0 |

0 |

0 |

3 |

809 |

6 |

72 |

9 |

881 |

|

Total |

0 |

0 |

0 |

0 |

64 |

7,155 |

11 |

606 |

75 |

7,761 |

|

Source: Bank Records |

||||||||||

|

Community Development Lending |

||||||||||

|

Activity Year |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|||||

|

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

|

|

2021 (Partial Year) |

0 |

0 |

0 |

0 |

15 |

1,109 |

1 |

66 |

16 |

1,175 |

|

2022 |

0 |

0 |

0 |

0 |

31 |

1,891 |

5 |

344 |

36 |

2,235 |

|

2023 |

0 |

0 |

0 |

0 |

16 |

4,120 |

4 |

36 |

20 |

4,156 |

|

2024 (Year-to-Date) |

0 |

0 |

0 |

0 |

2 |

35 |

1 |

160 |

3 |

195 |

|

Total |

0 |

0 |

0 |

0 |

64 |

7,155 |

11 |

606 |

75 |

7,761 |

|

Source: Bank Records |

||||||||||

Examples of community development lending where the bank has been most responsive to community development needs are discussed in the individual assessment area sections of this evaluation, as applicable.

Qualified Investments

During the evaluation period, CSB made 143 qualified investments totaling approximately $20.8 million, which includes 101 donations of approximately $236,000. As the bank was responsive to assessment area community development needs, these totals also include 31 investments and donations totaling approximately $17.2 million benefitting the broader statewide and regional area that includes the bank’s assessment areas.

CSB’s qualified investments represented 3.5 percent of total assets and 16.5 percent of total securities, as of March 31, 2024. The comparable institutions’ qualified investments ratios ranged from 0.4 percent to 2.7 percent of total assets, and 1.9 percent to 6.5 percent of total securities.

CSB’s performance is favorable to these institutions. CSB’s ratios have increased since the prior

evaluation when qualified investments represented 1.7 percent of total assets and 8.8 percent of total securities. Examiners recognize that donations drastically increased compared to the prior evaluation’s total of $87,000, which can be more impactful on a community. The following tables reflect the number and dollar volume of qualified investments by assessment area, purpose, and activity year.

|

Qualified Investments by Assessment Area |

||||||||||

|

Assessment Area |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|||||

|

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

|

|

Non-Metro |

0 |

0 |

9 |

7 |

20 |

1,032 |

57 |

2,343 |

86 |

3,382 |

|

Cedar Rapids Metro |

2 |

6 |

7 |

5 |

15 |

27 |

2 |

220 |

26 |

258 |

|

Dubuque Metro |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Statewide Activities |

0 |

0 |

1 |

<1 |

0 |

0 |

4 |

2,420 |

5 |

2,420 |

|

Regional Activities |

2 |

965 |

5 |

6,465 |

14 |

5,500 |

5 |

1,805 |

26 |

14,735 |

|

Total |

4 |

971 |

22 |

6,477 |

49 |

6,559 |

68 |

6,788 |

143 |

20,795 |

|

Source: Bank Data |

||||||||||

|

Qualified Investments |

||||||||||

|

Activity Year |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|||||

|

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

# |

$(000s) |

|

|

Prior Period |

0 |

0 |

4 |

5,465 |

0 |

0 |

7 |

2,520 |

11 |

7,985 |

|

2021 (Partial Year) |

0 |

0 |

1 |

1,000 |

1 |

1,200 |

5 |

2,245 |

7 |

4,445 |

|

2022 |

2 |

965 |

0 |

0 |

0 |

0 |

5 |

1,870 |

7 |

2,835 |

|

2023 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

2024 (Year-to-Date) |

0 |

0 |

0 |

0 |

17 |

5,294 |

0 |

0 |

17 |

5,294 |

|

Subtotal |

2 |

965 |

5 |

6,465 |

18 |

6,494 |

17 |

6,635 |

42 |

20,559 |

|

Qualified Grants & Donations |

2 |

6 |

17 |

12 |

31 |

65 |

51 |

153 |

101 |

236 |

|

Total |

4 |

971 |

22 |

6,477 |

49 |

6,559 |

68 |

6,788 |

143 |

20,795 |

|

Source: Bank Data |

||||||||||

Examples of qualified investments where the bank has been most responsive to community development needs are discussed in the individual assessment area sections of this evaluation, as applicable. Such examples are limited to donations, as equity investments that received consideration were not unique and are similar to those generally seen at other institutions.

Community Development Services

The bank received consideration for a total of 73 community development services that primarily consisted of providing support to economic development- and revitalization/stabilization-related organizations. CSB personnel provided technical or financial expertise to these organizations in many ways, all related to their employment with the institution. Employees dedicated their time and resources to 29 different organizations over the evaluation period. Most notably, in the majority of these entities, bank employees served in a board member or officer capacity.

Comparable institutions provided between 22 and 77 services; CSB compares reasonably to these institutions. The following tables illustrate the bank’s community development services in each category by assessment area and activity year.

|

Community Development Services by Assessment Area |

|||||

|

Assessment Area |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|

# |

# |

# |

# |

# |

|

|

Non-Metro |

5 |

2 |

22 |

20 |

49 |

|

Cedar Rapids Metro |

1 |

5 |

8 |

0 |

14 |

|

Dubuque Metro |

0 |

0 |

10 |

0 |

10 |

|

Total |

6 |

7 |

40 |

20 |

73 |

|

Source: Bank Data |

|||||

|

Community Development Services |

|||||

|

Activity Year |

Affordable Housing |

Community Services |

Economic Development |

Revitalize or Stabilize |

Totals |

|

# |

# |

# |

# |

# |

|

|

2021 (Partial Year) |

1 |

1 |

7 |

6 |

15 |

|

2022 |

2 |

2 |

11 |

4 |

19 |

|

2023 |

2 |

2 |

11 |

5 |

20 |

|

2024 (Year-to-Date) |

1 |

2 |

11 |

5 |

19 |

|

Total |

6 |

7 |

40 |

20 |

73 |

|

Source: Bank Data |

|||||

CSB offers retail services that increase access to financial services in the assessment areas, which include the alternative services described under this document’s Description of Institution section. These services are generally free of charge to bank customers, which benefits low- and moderate- income individuals. CSB operates two branch offices and automated teller machines in underserved middle-income geographies. Consumer and commercial checking accounts are offered with no minimum balance or service fees.

As mentioned previously, the bank participates in various lending programs that aid small businesses, small farms, and potential homeowners. The bank originated three PPP loans totaling nearly $57,000, since the last evaluation. CSB also continued to offer loan accommodations and overdraft fee waiving measures implemented to accommodate customers affected by the COVID-19 pandemic.

Retail banking services and loan programs are consistent among CSB’s assessment areas. The institution also invests in, and is involved with, other community activities that do not specifically meet the definition of community development; however, bank personnel are commended for their involvement in these other community events. Qualitative examples of community development services where the bank was responsive are mentioned in the individual assessment area sections of this evaluation, as applicable.

DISCRIMINATORY OR OTHER ILLEGAL CREDIT PRACTICES REVIEW

The bank’s compliance with the laws relating to discrimination and other illegal credit practices was reviewed, including the Fair Housing Act and the Equal Credit Opportunity Act. Examiners did not identify any evidence of discriminatory or other illegal credit practices inconsistent with helping meet community credit needs.

NON-METRO ASSESSMENT AREA – Full-Scope Review

DESCRIPTION OF INSTITUTION’S OPERATIONS IN THE NON-METRO ASSESSMENT AREA

The Non-Metro Assessment Area consists of Clayton and Delaware counties in their entirety, which are non-metropolitan in nature. CSB operates from five offices in the assessment area.

Economic and Demographic Data

According to 2020 U.S. Census data, the assessment area consists of ten census tracts, including one moderate- and nine middle-income tracts. Clayton County census tract 701 changed from middle- to moderate-income and Delaware County census tract 9502 changed from upper- to middle-income since the previous evaluation. The moderate-income census tract is along the Mississippi River in the northeast corner of the assessment area. During the review period, Clayton County census tracts 702-705 were designated annually as underserved middle-income geographies; Clayton County census tract 701 was designated as underserved in 2021. The following table illustrates select demographic characteristics of the Non-Metro Assessment Area.

|

Demographic Information of the Assessment Area |

||||||

|

Demographic Characteristics |

# |

Low % of # |

Moderate % of # |

Middle % of # |

Upper % of # |

NA* % of # |

|

Geographies (Census Tracts) |

10 |

0.0 |

10.0 |

90.0 |

0.0 |

0.0 |

|

Population by Geography |

34,531 |

0.0 |

8.3 |

91.7 |

0.0 |

0.0 |

|

Housing Units by Geography |

17,241 |

0.0 |

9.8 |

90.2 |

0.0 |

0.0 |

|

Owner-Occupied Units by Geography |

11,285 |

0.0 |

9.3 |

90.7 |

0.0 |

0.0 |

|

Occupied Rental Units by Geography |

3,193 |

0.0 |

12.3 |

87.7 |

0.0 |

0.0 |

|

Vacant Units by Geography |

2,763 |

0.0 |

9.5 |

90.5 |

0.0 |

0.0 |

|

Businesses by Geography |

4,664 |

0.0 |

8.3 |

91.7 |

0.0 |

0.0 |

|

Farms by Geography |

897 |

0.0 |

9.7 |

90.3 |

0.0 |

0.0 |

|

Family Distribution by Income Level |

9,470 |

15.7 |

18.3 |

24.9 |

41.1 |

0.0 |

|

Household Distribution by Income Level |

14,478 |

20.1 |

18.2 |

18.0 |

43.7 |

0.0 |

|

Median Family Income - Non-metropolitan Iowa |

$71,763 |

Median Housing Value |

$137,942 |

|||

|

Median Gross Rent |

$637 |

Families Below Poverty Level |

5.2% |

|||

|

Source: 2020 U.S. Census and 2023 D&B Data. (*) The NA category consists of geographies that have not been assigned an income classification. Due to rounding, totals may not equal 100.0%. |

||||||

According to 2023 D&B data, service industries represent the largest portion of businesses and farms at 27.0 percent; followed by non-classifiable establishments at 19.5 percent; agriculture, forestry, and fishing at 16.1 percent; and retail trade at 8.8 percent. In addition, 68.5 percent of assessment area farms and businesses have four or fewer employees, and 93.1 percent operate from a single location.

The FFIEC-estimated median family income levels are used to analyze home mortgage loans under the Borrower Profile criterion and to analyze certain community development activities. The median family income levels for the non-metropolitan areas of Iowa are presented in the following table by year.

|

Median Family Income Ranges |

||||

|

2021 ($70,500) |

<$35,250 |

$35,250 to <$56,400 |

$56,400 to <$84,600 |

≥$84,600 |

|

2022 ($78,900) |

<$39,450 |

$39,450 to <$63,120 |

$63,120 to <$94,680 |

≥$94,680 |

|

2023 ($86,300) |

<$43,150 |

$43,150 to <$69,040 |

$69,040 to <$103,560 |

≥$103,560 |

|

Source: FFIEC |

||||

Competition

CSB’s assessment area is considered moderately competitive in the market for financial services. The Federal Deposit Insurance Corporation Deposit Market Share Report as of June 2023 reflects that 12 insured institutions operate from 24 offices within the assessment area. These institutions mostly consist of smaller community banks operating branch offices in the area. Of these institutions, CSB ranked 2nd with 11.7 percent of the deposit market share. The top ranking bank held 45.7 percent of the deposit market share.

Additionally, although the bank is not required to collect or report its small business or small farm loan data, and analyses under the Lending Test do not include direct comparisons to aggregate lending data, this aggregate lending data reflects the level of demand for these loan types and may be referenced throughout this evaluation for this purpose. CRA aggregate data for 2022 shows 17 lenders reported 655 small farm loan originations and 41 lenders reported 607 small business loan originations in the assessment area. To further illustrate the level of competition and demand for loans, 2022 HMDA aggregate data shows 89 institutions reported 904 home mortgage loan originations/purchases within the assessment area. CSB ranked 1st with 17.2 percent of the market share by number of loans.

Community Contact

As part of the evaluation process, examiners contact third parties active in the assessment area to assist in understanding economic conditions and identifying credit needs. This information helps to determine whether local financial institutions are responsive to community credit needs and provides context regarding available lending opportunities.

Examiners referenced an interview with a representative from an economic development organization within the assessment area. The contact noted the economy is centered around agriculture. While farmers have been enjoying wider margins and higher commodity prices in recent years, prices have started to contract and inputs have stayed the same or become more expensive. Smaller farms are disappearing as larger farms consolidate with them, but the pace has

slowed in recent years. There is low unemployment due to increasing manufacturing activity in the area. Larger firms have either expanded or moved to the area, and smaller firms (under 50 employees) are also doing well. The availability of housing is tight, especially affordable housing; however, the housing market showed signs of easing during the previous year. The housing shortage has also kept housing prices and rentals higher than average. Some housing starts (individual and multi-family) have been made recently, in light of the anticipated job growth in the manufacturing sector. Affordable housing is available, but is generally not near manufacturing sites; therefore, transportation for workers can be an issue.

Credit and Community Development Needs and Opportunities

Considering information from the community contact, bank management, and demographic and economic data, small farm, small business, and home mortgage loans (especially affordable housing) are the primary credit needs of the assessment area. Call Reports filed by area financial institutions also support this assertion. Analyses performed show that community development opportunities exist in the area, though on a limited basis due to lower population and need.

CONCLUSIONS ON PERFORMANCE CRITERIA IN THE NON-METRO ASSESSMENT AREA

LENDING TEST

CSB demonstrated reasonable performance under the Lending Test in the Non-Metro Assessment Area, as supported by reasonable Geographic Distribution and Borrower Profile performance.

Geographic Distribution

The institution’s geographic distribution of loans reflects reasonable dispersion throughout the assessment area. The bank’s reasonable performance in all three lending products supports this conclusion.

Small Farm Loans

The geographic distribution of small farm lending reflects reasonable dispersion given the performance context. As shown in the following table, the institution’s lending in the assessment area’s one moderate-income census tract is lower than the demographic data; however, D&B’s reporting reflects that a small percentage of farms are located within this census tract (9.7 percent). Review of the bank’s agricultural lending since the prior evaluation noted limited originations in the northern section of Clayton County; however, this appears consistent with prior dispersions.

Management stated and examiners confirmed that the legacy Edgewood branch, which is located on the south border of Clayton County, handles a majority of CSB’s agricultural lending and houses a more experienced lending team. The sole moderate-income census tract resides in the northeast section of Clayton County, approximately 30 miles from the Edgewood office, and was previously designated by 2015 ACS as a middle-income geography. Management also explained that competition is a significant factor. Examiners confirmed this statement noting that 2022 CRA Aggregate shows 17 lenders reported 655 small farm loans with 13.3 percent of total loans in the moderate-income census tract. Two of these lenders, which are larger community-based banks,

dominate the market share and have a greater presence in this specific area. Further, this rural assessment area is comprised of several middle-income census tracts and as expected, CSB’s lending dispersion corresponds to the loan product type and related demand. Management stated goals are in place to expand the bank’s footprint into the northern section of Clayton County, now that a more experienced agriculture lender is located in the Garnavillo branch.

|

Geographic Distribution of Small Farm Loans |

|||||

|

Tract Income Level |

% of Farms |

# |

% |

$(000s) |

% |

|

Moderate |

9.7 |

3 |

2.5 |

425 |

3.3 |

|

Middle |

90.3 |

118 |

97.5 |

12,309 |

96.7 |

|

Totals |

100.0 |

121 |

100.0 |